how much is the nys star exemption

Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes. Exemption forms and applications.

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR.

. The New York School Tax Relief Program also known as STAR provides New York homeowners with partial exemptions for school property taxes. It is necessary that you own a home and have an income of 50000 or less owner and their spouse together STAR exemptionthis is a reduction on your school tax bill. New York City residents.

Enhanced STAR exemption applicants must submit form RP-425-E Enhanced STAR application or form RP-425-Rnw Enhanced STAR renewal application with their local. The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the value of the. The benefit is estimated to be a 293 tax reduction.

The Enhanced STAR exemption amount is 74900 and the school tax rate is 12123456 per thousand. 4 rows 250000 or less for the STAR exemption The income limit applies to the combined incomes of only. However STAR credits can rise.

Also question is how much will my. The total amount of school taxes owed prior to the STAR. Enhanced STAR is for homeowners 65 and older whose total household income for all owners.

Residents of New York City or Nassau County. Owners who were receiving the benefit as of March 15 2015 can continue to receive it. A New York State school tax relief program which provides a partial exemption from school property taxes for homeowners.

88050 or less for the 2020-2021. You need to have. The 2022 STAR exemption amounts are now available.

74900 13123456 1000 90805. 20222023 STAR exemption amounts STAR exemption amounts and maximum savings now available online. HARRIS-PERO BOTELHO PLLC.

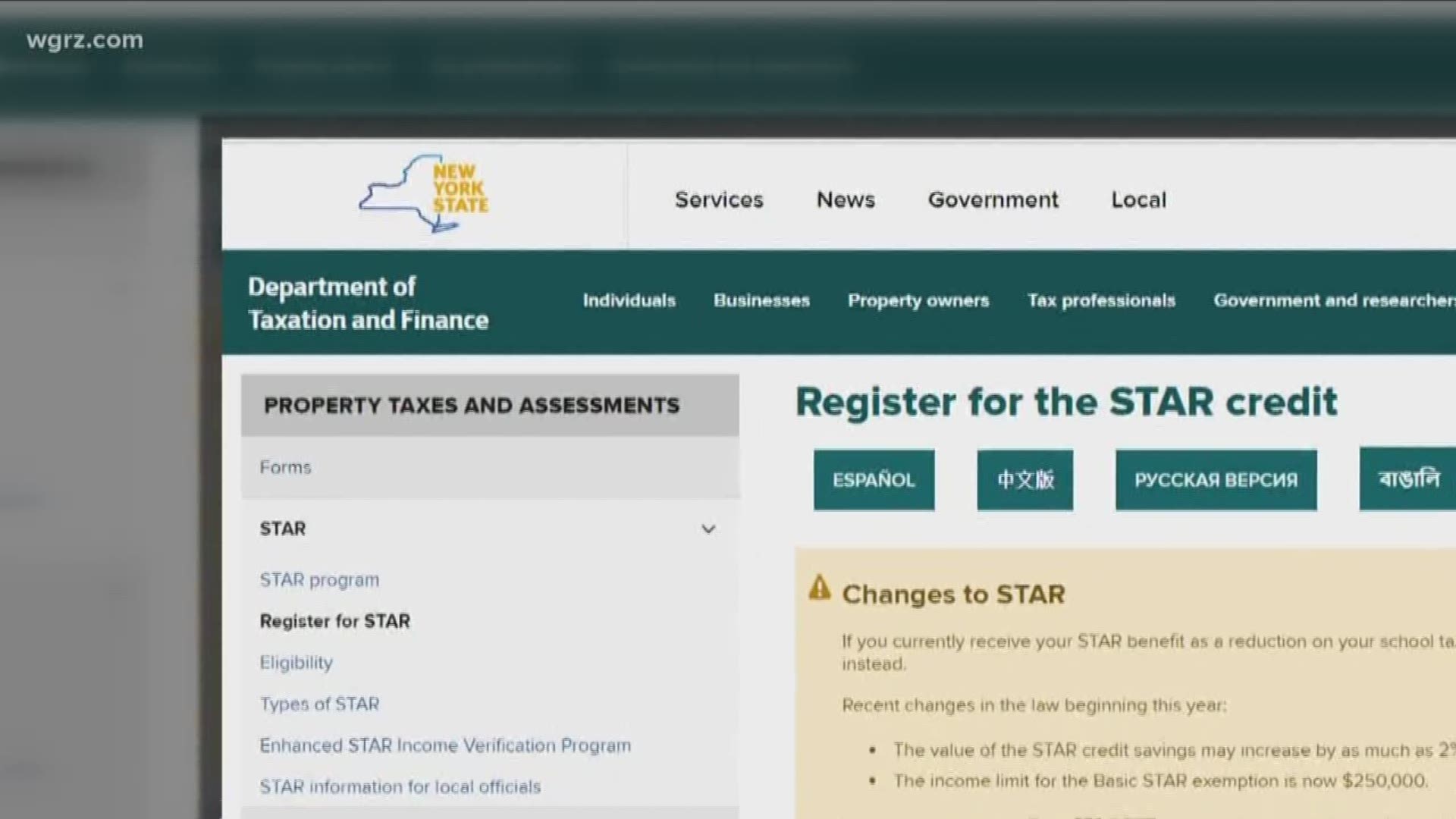

While the maximum annual income eligibility requirement for Basic STAR remains unchanged at 500000 whats changed is that only those whose income is 250000 or less will be able to. In 2016 STAR was changed by state law from a property tax exemption to an income tax credit. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application instructions above STAR forms.

Basic STAR is for homeowners whose total household income is 500000 or less. Homeowners with existing STAR exemptions may continue to receive the exemption and to upgrade to the Enhanced STAR exemption when eligible. Seniors will receive at least a 50000 exemption from the full value of their property.

Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year. If you earn less than 500000 and own your. The formula below is used to calculate Basic STAR exemptions.

The Maximum Enhanced STAR exemption savings on our website is 1000. The enhanced STAR exemption will provide an average school property tax reduction of at least. How much is NYS Enhanced STAR exemption.

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or. When did STAR begin. How much is the NYS STAR credit.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. 5 rows If you are currently receiving STAR or E-STAR as a property tax exemption and you earn.

What Is The Enhanced Star Property Tax Exemption In Nyc Youtube

Ny Star Program Registration For Homeowners Updates To The New York Star Program And How To Register F Students Day Social Studies Teacher Democratic Society

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

The School Tax Relief Star Program Faq Ny State Senate

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Understanding The School Tax Relief Star Program In Nyc Yoreevo Yoreevo

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

This Worksheet Has 21 Earth Science Regents Questions About The Life Cycle Of St Fraction Word Problems Complex Sentences Worksheets Persuasive Writing Prompts

Register For The School Tax Relief Star Credit By July 1st Greene Government

Pictures Of Nursing Digital Gallery Nlm Exhibition Program Vintage Nurse Nurse Commemorative Stamps

Star Property Tax Credit Make Sure You Know The New Income Limits Greenbush Financial Group

Many Homeowners Face A Choice On How To Best Get Their Star Wgrz Com

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Summer Reading At New York Libraries Division Of Library Development Nys Library Library Posters Reading Posters Summer Reading

5 Things You Must Know Before You Call Your Window Company How Much Does Glass Replacement Cost Glass Replacement Window Replacement Cost Window Replacement